Urban Mobility Innovations: Present Trends Shaping Future Innovations

- Mallek Aminullah

- Mar 4, 2023

- 13 min read

Updated: Mar 29, 2023

Table of Contents

Introduction

Since the pandemic, there has been a rise in interest for understanding the economic and societal value derived from innovations in Mobility. Liuima (2021) shared that the “New Normal” has shifted consumer mobility preferences across cities, suburbs, and rural areas.

The impact of distributed teams has altered commuting patterns, and existing health concerns have increased the use of personal mobility modes. In this research piece, we will first look at various systemic changes that are informing individual mobility needs. We then identify the technologies and solutions that are available to address those needs, with a lens on how the business values generated could also extend to societal benefits. Finally, we explore emerging innovations to hypothesize what the future of mobility innovation could look like.

Signals for Emerging Needs in Mobility

The Covid-19 pandemic undoubtedly impacted the mobility of humans. Consequently, user preferences on modes of mobility were also affected (Hattrup-Silberberg et al., 2020). Furcher et al. (2021) shared that travel is gradually increasing, with 51% of mobility consumers intending to travel less than before the pandemic. As we reach the tail end of the pandemic, individuals are augmenting their lives to live cautiously, with hygiene and social distancing in mind, which influences people’s needs and preferences when deciding on mobility options.

An example of this is the reluctance of consumers to adopt public transportation or shared mobility services, the latter of which saw a 4% decline in journeys globally (Miller et al., 2022). This decline was largely driven by hygiene and distancing needs. The increasing costs per journey and lack of availability made personal transportation modes more favorable. This suggests consumers are beginning to prioritize lower costs per journey and convenience, alongside their hygiene and distancing needs.

Most recently, the Ukraine-Russia war has impacted the global economy, with extensive adverse effects on the global supply chain and restrictions on gas supply causing a cascading effect to everyday people in the form of inflation (Guenette et al., 2022). As rising costs are pressuring consumers to rethink how they spend their money, for instance, rising gas prices have compelled mobility consumers to opt for hybrid or fully electric vehicles (EVs). Miller et al. (2022) supports this by sharing that 52% of consumers who intend to buy a car, intend to choose either hybrid vehicles (hybrids) or EVs. Government regulation encouraging the use of hybrids and EVs will make them more affordable. Europe and China have strict targets for restricting CO2 emissions and are pushing for mass adoption of hybrids and EVs (Richards, 2021).

Consumer preferences are shaped by the external factors enabling mobility (gas prices, hygiene, availability etc.). Assessing these emerging needs is helpful when speculating what the future of mobility will and should look like. We should also analyze the current developments in mobility technologies by studying business implications and investment trends. This allows us to plot the path towards an equitable ecosystem for mobility.

Table of Figures

Figure 1 | Global Capital Invested & Deal Count for Public Transit Platforms |

Figure 2 | Global Capital Invested & Deal Count for Micromobility |

Figure 3 | Capital Invested for Micromobility, by Type (2012- FY 2022 Q3) |

Figure 4 | Percentage of Capital Invested for Micromobility, by Regions |

Figure 5 | Number of Companies Founded for E-Mobility Solutions |

Figure 6 | Global Capital Invested & Deal Count for Electric Vehicle Platforms |

Figure 7 | Top 10 Deals for Electric Vehicle Platforms, by Deal Type |

Figure 8 | Global Capital Invested & Deal Count for EV Charging Infrastructure |

Figure 9 | Proportion of Global Capital Invested for EV Charging Infrastructure, by Region (2012- FY 2022 Q3) |

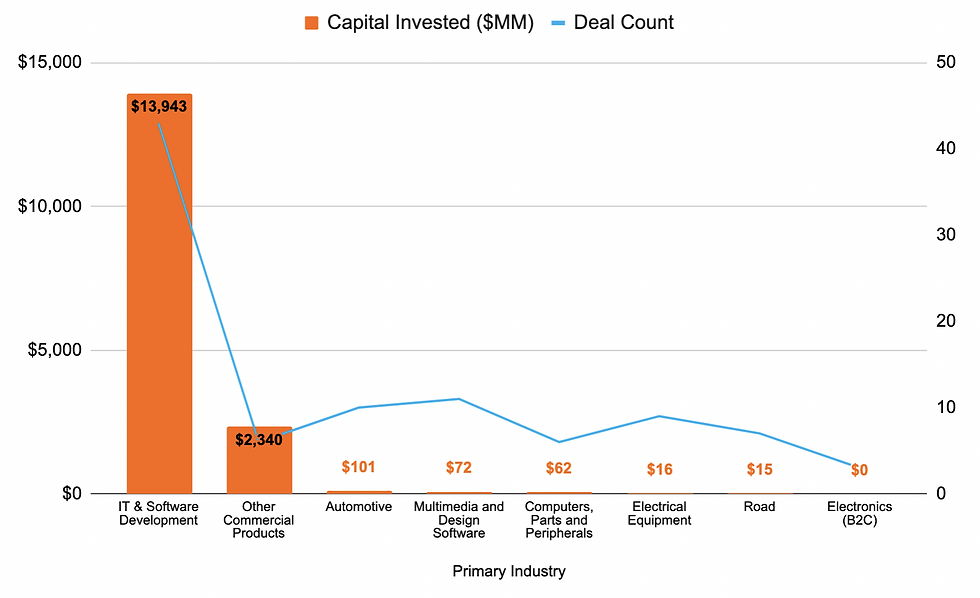

Figure 10 | Capital Invested & Deal Count for Autonomous Mobility Development, by Industry (2012- FY 2022 Q3) |

The State of Current Innovations

There is a wide variety of technological innovations in the space of mobility today. Some employ deep tech, (IoT, autonomous robotics, visual intelligence) which requires significant engineering for deployment, and others utilize shallow tech (big data & A.I, cloud technologies) which are relatively simpler to deploy. Regardless, the following innovations are useful for tackling specific challenges in mobility. Analyzing how these innovations are solving specific mobility issues could help understand the desired role they have in the mobility ecosystem as a whole. The following sections highlight several impactful mobility innovations available today.

Public Transit Information Platforms

Public transit information platforms refers to platforms that leverage public transit data and deliver real-time descriptive and prescriptive insights to users on their journey. This helps users plan their journeys by recommending departure times, routes, and modes of transport. Taking advantage of big data provided by public transportation networks, these smart travel assistants aim to reduce friction and enhance the user experience of urban mobility. For example, Munich has relied on these digital travel assistants to aid over 722 million urban travelers along their journey (Esser, 2020). Usually through a mix of A.I. and human-machine interfaces such as voice recognition and chats.

As these solutions employ more mature technologies, providers today are looking at various ways to enhance offerings. Providers are developing a wide range of services as a way to differentiate. Some even integrate payment gateways to allow users to book and pay for public transportation services (Esser, 2020). The startups below showcase these capabilities.

Moovit

Total Raised: $133M

A Mobility-as-a-service (MaaS) platform combining information from public transit operators and authorities with live information from the user community. Simplifying urban mobility and offering travelers a real-time picture, including the best route for their journey.

CitySwift

Total Raised: $8.96M

Provider of a transportation technology platform designed to facilitate data-driven bus scheduling. The platform measures historical patterns to see what effect weather, traffic and other events have on one's routes. Branded as a mobility intelligence platform, CitySwift enables public transport providers to optimize their bus networks by delivering insights through the use of big data and data science.

Figure 1: Global Capital Invested & Deal Count for Public Transit Platforms

Source: Pitchbook Database

Public transit platforms were attracting low levels of investments over the past 10 years, while the deal count has remained fairly steady over the years, at an average of 13 deals with some fluctuations in earlier years of the period. This is potentially due to these platforms requiring more simple technologies to deploy as highlighted earlier. The amount of capital invested for public transit platforms saw a peak in 2020. This was largely driven by Intel’s $915 million acquisition deal of Moovit. This acquisition allowed Intel to accelerate development of self-driving robo-taxis through its autonomous car company Mobileye (Lunden, 2020).

Micromobility

Micromobility is defined by lightweight and small vehicles that have speeds no more than 30 miles per hour (Sandt, 2019), which includes e-scooters and e-bikes. These innovations have been widely adopted in most major cities, serving as viable alternatives to personal cars or public transportation in urban mobility. This vehicle category alleviates last mile mobility pains by extending the connectivity of individuals to their points of interests.

However, these innovations do come with their fair share of challenges. As this mode of transportation is not easily regulated, successful implementation demands cooperation between providers and local authorities. Hasenber & Schönberg (2020) highlight the poor implementation of e-scooters in Paris that resulted in the city being crowded with e-scooters that disrupted traffic and sidewalks. The city then limited the number of e-scooter providers to 3 and a maximum of 15,000 scooters, along with designating 2,500 special parking spaces. Proving that while the solution is simple, caution and awareness is needed for effective deployment and management.

Figure 2: Global Capital Invested & Deal Count for Micromobility

Source: Pitchbook Database

The investment data above looks at a variety of micromobility solutions including, but not limited to, bike sharing and e-scooters,providing a comprehensive view of investment trends across micromobility solutions. Micromobility solutions have seen an overall increasing trend in both capital invested and annual deal count. Interestingly, 2021 (post-pandemic) saw a peak in annual deal count for these technologies, which resulted in a total capital invested of $7.09 billion. This is close to a threefold increase in capital invested compared to only $2.66 billion in 2020.

Figure 3: Capital Invested for Micromobility, by Type (2012- FY 2022 Q3)

Source: Pitchbook Database

Figure 3 illustrates how the capital invested in micromobility solutions is allocated throughout the 2 micromobility modes discussed earlier. The majority of capital invested is towards bike sharing platforms (which includes e-bikes), at $9.60 billion in investments. While e-scooters received $4.10 billion in investments, which is slightly less than half the investments poured into bike sharing platforms. Schellong et al. (2019) indicated that e-scooters deployed in a shared model face a profitability challenge. Heavy usage, rough handling, and vandalism significantly decreases their durability, resulting in higher operational and maintenance costs.

The significant investments into these mobility technologies is driven by the high capital requirements for scaling into multiple cities or countries. For instance, most of these companies would have to provide physical scooters, bikes, and infrastructure to meet the needs of cities in which they operate. Bike sharing and electric scooter operations are still fairly analog, requiring local human intervention to perform maintenance and management. Startups like Bird have been struggling to continue operations, let alone expand and scale them globally. After overstating revenues, Bird has had to scale back or discontinue certain or all operations as they will not be able to meet next year’s obligations without additional funding (Bellan, 2022).

Figure 4: Percentage of Capital Invested for Micromobility, by Regions

Source: Pitchbook Database

It is notable that investment trends could vary based on the region, as individual cities and countries will have different levels of interests in propagating micromobility solutions. As figure 4 shows, North America (United States, Canada, and Mexico) and Asia are the most active regions for investments into micromobility solutions. In North America, this is largely investments from the United States, whereas China accounts for approximately 80% of investments in Asia.

Europe has seen an encouraging growth in investment activity in the past 5 years, accounting for close to 50% of global investments most recently. This is driven by European Commissions’ aspirations to cut greenhouse gas emissions by at least 55% by 2030 to achieve climate-neutral levels by 2050 (d’Aprile et al., 2020). As Europe continues its decarbonization efforts, it will be insightful to track their developments in the coming years.

E-Mobility

E-Mobility here represents technological advancements that rely on electric powered mechanisms and connected infrastructure to enable movement, which includes EVs, hybrids, and charging stations. While e-scooters and e-bikes may be considered e-mobility innovations, we will not be including them in this segment.

E-Mobility innovations are largely driven by the growing initiatives from the public sector to combat climate change. Governments are putting in place legislation that encourages the production and adoption of EVs and hybrids, to combat climate change and meet strict targets. Europe has stated that newly registered vehicles should emit an average of 50% less CO2 in 2030 (Riederle & Bernhart, 2021). This has painted a favorable light on e-mobility solutions, encouraging its adoption and deployment.

Figure 5: Number of Companies Founded for E-Mobility Solutions

Source: Pitchbook Database

Electric vehicle (EV) platforms refers to companies developing and manufacturing electric vehicles and powertrains. Between 2012 and 2021, the number of companies providing electric vehicle platforms has seen an 11.6% compound annual growth rate (CAGR). Whereas, the number of EV charging infrastructure companies founded saw a 7% CAGR for the same period. Here are some examples of startups that have made their mark.

Rivian

Market Cap: $27.20B

Rivian Automotive designs, develops and manufactures category-defining electric vehicles and accessories. Providing a range of vehicles catered for long distance battery powered driving. The company also provides vehicles, software, and charging solutions to electrify fleets of commercial vehicles. Most notably its commitment to delivering 10,000 vehicles to Amazon to assist them in achieving their ambitious climate goals.

ChargePoint

Market Cap: $3.92B

Provides networked electric vehicle charging system infrastructure and cloud-based services that enable consumers to locate, reserve, and authenticate EV charging. Its product range includes solutions across home, commercial, and fast-charging applications.

Figure 6: Global Capital Invested & Deal Count for Electric Vehicle Platforms

Source: Pitchbook Database

Electric vehicle platforms saw an exponential increase in the amount of capital invested in 2020 and 2021, passing the $20 billion mark and coming close to $30 billion in 2021. The annual deal count for electric vehicle platforms was increasing gradually for the period, which suggests much higher value deals occurring most recently. This investment activity may indicate a heightened appetite from investors for these E-mobility technologies, given the market factors encouraging its adoption, as mentioned previously.

Figure 7: Top 10 Deals for Electric Vehicle Platforms, by Deal Type

Source: Pitchbook Database

Figure 7 showcases the top 10 deals for EV technologies, highlighting the dominant types of deals taking place. Most recently, later stage VCs and PIPE (private investment in public equity) deals are dominating the investment scene. Based on this recent activity, one may infer that investors perceive market readiness and improved propensity for scale in these technologies. Notably, Rivian’s IPO in 2021, which allowed them to raise $11.93 billion, accounts for 40% of the total capital invested for electric vehicle platforms in 2021.

Figure 8: Global Capital Invested & Deal Count for EV Charging Infrastructure

Source: Pitchbook Database

EV charging infrastructure is one of the critical developments that enables the accelerated adoption of E-Mobility solutions. Therefore, there is an almost parallel investment trend to that of electric vehicle platforms. The amount of capital invested shows an increasing trend for the period, with exponential increases in the year 2020 and beyond. This resulted in a CAGR of 27.1% from 2012 to 2021.

Figure 9: Proportion of Global Capital Invested for EV Charging Infrastructure, by Region (2012- FY 2022 Q3)

The majority of global capital invested for EV charging infrastructure is located in the United States at (46%). Followed by Asia and Europe, at 28% and 22% respectively.

The capital invested in the United States is spread across 202 companies, whereas the capital invested in Europe is spread across 276 companies. The larger number of companies in Europe might be the outcome of the European national development plans that favor E-mobility providers. It also suggests investors placing higher value to EV charging infrastructure providers in the United States as compared to Europe.

Source: Pitchbook Database

Source: Glydways

Future State of Mobility Innovations

As with most technological fields and sectors, what follows digitization and artificial intelligence is automation (Marr, 2022). Developing smarter vehicles that can intuitively act and decide for themselves has been the aspiration, reducing tasks for humans and improving performance efficiency. This perceived convenience is how users derive value and what drives the conception of autonomous mobility solutions.

Source: Muoio & Radovanovic (2016)

As a reference, we are concerned with autonomous mobility providers, which are classified at levels 4 and 5, as illustrated in the graphic above and require minimum to no intervention from the driver, leaving it virtually driverless (Muoio & Radovanovic, 2016). A machine this intuitive requires significant technological development in hardware, software and validation costs (Heineke et al., 2021). Hardware refers to sensing technologies, both at component and system-level development. Software is the testing and documentation needed to meet standards, and validation includes simulation tools, data collection and storage.

Mills (2022) shared that a single autonomous vehicle produces up to 5,894 terabytes in just one year, more data produced than 320 million Twitter users. Autonomous mobility providers are challenged by building intelligent machines that could process these vast amounts of data and autonomously make decisions in accordance to social expectations and regulatory standards. Automotive companies like Tesla, Ford, and General Motors have embarked on their respective journeys to what they envision autonomous mobility should look like. However we should not overlook the participation of companies from other industries joining the fray in autonomous mobility development.

Figure 10: Capital Invested & Deal Count for Autonomous Mobility Development, by Industry

(2012- FY 2022 Q3)

Source: Pitchbook Database

Figure 10 shows that capital invested in autonomous mobility developments is being led by IT & Software development companies. Attracting close to $14 billion in investments for the period, and dwarfing the $101 million invested from automotive companies. Considering the vast amount of data that needs to be computed, IT & Software development companies are well positioned to leverage their in-house expertise to execute through advanced autonomous driving simulators, and systems.

Mass adoption of autonomous mobility solutions could stand to bring a variety of public benefits. Real estate value could be gained from redevelopment of unnecessary parking spaces, productive commuting times, and safer roadways. These benefits could exceed $800 billion a year by 2030, according to Heineke & Kampshoff (2019). Heineke et al. (2021) shared that the main barrier to mass adoption of autonomous vehicles is favorable regulation, which currently are most common at the city-level. However, with these regulatory initiatives being few and far in between, we might only realize autonomous mobility benefits in the long term. Most recently, given the economic downturn, companies like Alphabet (Google’s parent company) are cutting losses on long term investments (Kruppa, 2022). This might further hinder the development of autonomous mobility.

Smart City Implications

Developments in modes of transportation will undoubtedly enable the development of the infrastructure surrounding them (Mills, 2022). As cities look to further welcome the deployment of smart mobility innovation, the implications of smart city initiatives is imminent. Public authorities will have to ensure their long term smart city projects do not restrict future development of future mobility innovations. The startup below showcases how future innovations in mobility could implicate the developments of smart city initiatives.

Glydways

Total Raised: $40.35M

Developer of a transportation system designed to revolutionize mobility and public transportation. The company operates profitably at existing mass transit fares. It offers a private car experience with zero greenhouse gas emissions. The Glydcar is an autonomous, personal, and on-demand vehicle carrying up to 4 passengers directly to their destination with no stops.

Conclusion

“The travel sector can only profit from urban mobility services in cities. For this, modes of transport need to complement each other and be integrated in an overarching customer touchpoint” VP of Marketing, Optibus |

Source: Esser (2020)

Urban mobility innovations are a fundamental aspect to how individuals perceive and interact with cities. While each mobility solution addresses specific challenges for users, each of these innovations have a role in improving the overall connectivity of individuals within a specified urban area, as no one mobility innovation could serve all urban mobility needs. Therefore, there is merit in taking an ecosystem-centric view when assessing opportunities in the urban mobility space. Recognizing that solutions would complement, rather than compete, with one another and building a mobility ecosystem that welcomes the variety of solutions could be impactful to urban users and residents alike.

Europe's efforts in advancing urban mobility solutions best exemplifies this. With growth in both investments in micromobility solutions as well as e-mobility solution providers. As they strive towards their strict climate goals, they have appropriated resources to accelerate the development of both micromobility and e-mobility solutions. Hence building an urban mobility ecosystem that could lead to a decarbonized society.

When developing an ecosystem, each urban mobility solution will face their own set of challenges. The difficulty then lies in determining and allocating resources to ensure a robust execution that is impactful for urban dwellers. Figure 10, indicates that competencies are transferable across industries and use cases. Therefore, tapping into skills and expertise in domains previously overlooked could also be valuable for stakeholders driving the development of urban mobility ecosystems. As urban mobility needs continue to change, stakeholders from public and private sectors will have to collaborate on both planning and execution to address those needs.

References

Bellan, R. (2022). Bird may not have enough funds to continue shared micromobility business. TechCrunch. URL: https://techcrunch.com/2022/11/14/bird-may-not-have-enough-funds-to-continue-shared-micromobility-business/. Accessed: December 11, 2022

d’Aprile, P., Engel, H., Helmcke, S., Hieronimus, S., Naucler, T., Pinner, D., ... & Witteveen, M. (2020). How the European Union could achieve net-zero emissions at net-zero cost. McKinsey & Company: Chicago, IL, USA.

Esser, J. (2020). Urban Mobility - The new battleground for the traveler? Roland Berger. URL: https://www.rolandberger.com/en/Insights/Publications/Urban-mobility-The-new-battleground-for-the-traveler.html. Accessed: November 13, 2022

Furcher, T., Holland-Letz, D., Rupalla, F., & Tschiesner, A. (2021). Car buying is on again, and mobility is picking up. McKinsey & Company. Retrieved: May, 2, 2022.

Guenette, J. D., Kenworthy, P. G., & Wheeler, C. M. (2022). Implications of the War in Ukraine for the Global Economy.

Hasenber, j., & Schönberg, J. (2020). Can bikes and scooters change our cities?. Roland Berger. URL: https://www.rolandberger.com/en/Insights/Publications/Can-bikes-and-scooters-change-our-cities.html. Accessed: November 07, 2022

Hattrup-Silberberg, M., Hausler, S., Heineke, K., Laverty, N., Möller, T., Schwedhelm, D., & Wu, T. (2020). Five COVID-19 aftershocks reshaping mobility's future. McKinsey & Company.

Heineke, K., Heuss, R., Kelkar, A., & Kellner, M. (2021). What’s next for autonomous vehicles? McKinsey & Company. URL: https://www.mckinsey.com/features/mckinsey-center-for-future-mobility/our-insights/whats-next-for-autonomous-vehicles. Accessed: November 21, 2022.

Heineke, K., & Kampshoff, P. (2019). Trends transforming mobility’s future. McKinsey & Company. URL: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-trends-transforming-mobilitys-future. Accessed: November 13, 2022.

Kruppa, M. (2022). Activist investor TCI calls on Google parent Alphabet to slash costs. Fast Company. URL: https://www.wsj.com/articles/activist-investor-calls-on-google-parent-alphabet-to-slash-costs-11668528859?mod=djemalertNEWS. Accessed: November 17, 2022

Liuima, J. (2021). The “New Normal” in mobility: How commuting patterns will evolve. Euromonitor International. URL: https://www.euromonitor.com/article/the-new-normal-in-mobility-how-commuting-patterns-will-evolve. Accessed: October 23, 2022

Lunden, I. (2020). Confirmed: Intel is buying urban mobility platform Moovit in a $900M deal. Techcrunch. URL: https://techcrunch.com/2020/05/04/confirmed-intel-is-buying-urban-mobility-platform-moovit-in-a-900m-deal/. Accessed: November 08, 2022

Marr, B. (2021). The future trends in mobility and transportation. URL: https://www.forbes.com/sites/bernardmarr/2022/05/13/the-future-trends-in-mobility-and-transportation/?sh=34f36a897379. Accessed: November 17, 2022

Miller, R., Cardell, M., & Batra, G. (2022). Why consumers are charging toward electric vehicles. Ernst & Young.

Mills, J. (2022).How autonomous mobility and smart cities are defining the future of mobility. Fast Company. URL: https://www.fastcompany.com/90760801/how-autonomous-mobility-and-smart-cities-are-defining-the-future-of-mobility. Accessed: November 29, 2022

Muoio, D., & Radovanovic , D. (2016). This is what the evolution of self-driving cars looks like. Business Insider. URL: https://www.businessinsider.com/what-are-the-different-levels-of-driverless-cars-2016-10. Accessed: Nov 10, 2022

Richards, R. (2021). Mobility Trends: 6 Developments driving the future of mobility. MassChallenge. URL: https://masschallenge.org/article/mobility-trends. Accessed: October 29, 2022

Riederle, S., & Bernhardt, W. (2021). E-Mobility Index 2021: China leads the market, Germany strengthens its position, while the USA experiences minor growth. Roland Berger. URL: https://www.rolandberger.com/en/Insights/Publications/E-Mobility-booms-despite-the-pandemic.html. Accessed: Nov 14, 2022

Sandt, L. (2019). The Basics of Micromobility and Related Motorized Devices for Personal Transport.

Schellong, D., Sadek, P., Schaetzberger, C., & Barrack, T. (2019). The promise and pitfalls of e-scooter sharing. Europe, 12, 15.